NJ Society of Professional Engineers Awards Dinner

Puharic and Associates will be sponsoring the NJ Society of Professional Engineers Awards Dinner on June 27th from 6:30 pm – 10:30 pm at Mercer Oaks Golf Club.

The NJSPE Awards were established to honor individuals and firms for achievements in the practice and profession of engineering.

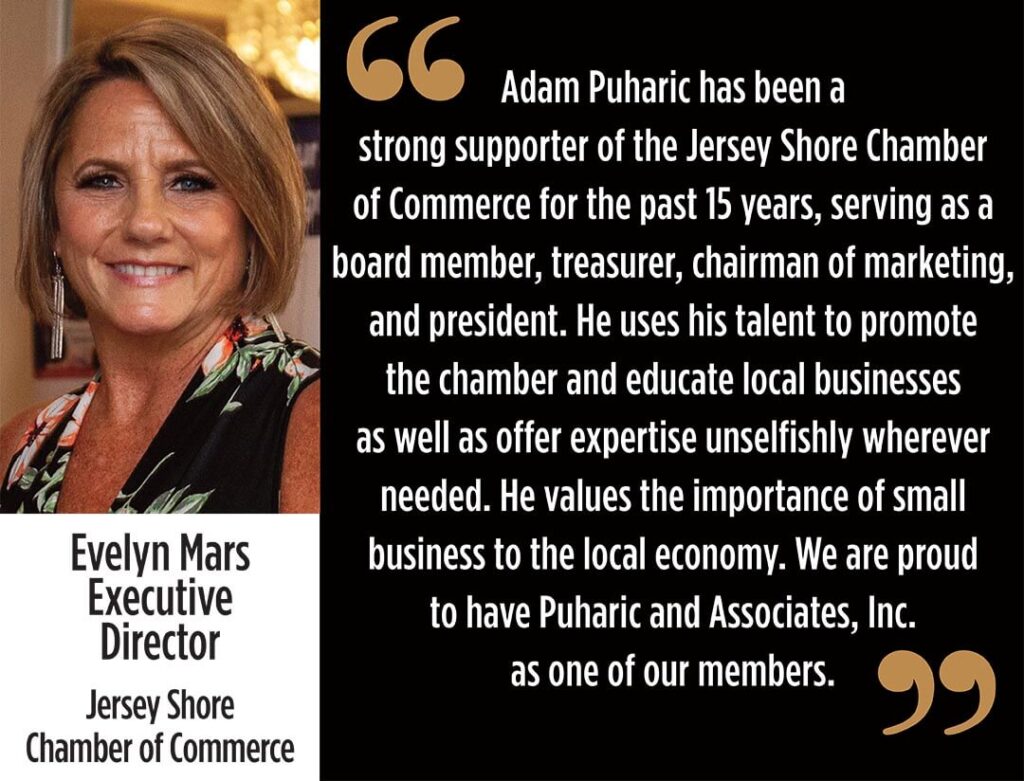

Insurance You Can Trust

Puharic and Associates, Inc. is a concierge-style risk management firm dedicated to clients seeking ‘sole remedy’ insurance expertise over point-and-click anonymous online quoting engines.

Puharic and Associates, Inc. provides sole-remedy consulting services for business owners from the phase of start-up through growth, asset management and estate planning, focusing on the client experience, client education, and risk management practices.

Risk Management Resources

Many carriers will offer one level of credit for water leak detection, and a higher level of credit for an automatic water shut-off valve.

Water Leak Detectors Are Inexpensive and Effective to Reduce or Mitigate Water Loss Insurance Claims

Recently, one of our carriers, the Andover Companies, posted a useful blog on the benefits of water leak detectors for buildings. Whether it is your home, office, rental property, storage facility, or vacation home, for less than $100, you can get real-time information on broken pipes, failed hot water heaters, or leaky basements.

Broken pipes, and faulty 2nd floor plumbing are a leading cause of property damage. The cold of winter can exacerbate flaws in the plumbing, and lead to rupture. The heat of summer can cause gaskets to shrink and fail.

According to Andover, there are several considerations to make when choosing a water leak detector:

- Is the alarm loud enough that it will be heard anywhere in my home?

- Can the alarm be turned off in-app, or can that only be done by hitting a button on the device?

- Will it integrate with my smart home system?

- Does it come with a leak-sensing cable that will help detect water along its entire length?

- Will the size of the device limit where it can be placed?

- Does it enable monitoring of room temperature and humidity as well?

When Is It Time To Notify The Professional Liability Carrier?

For over 16 years, I’ve filed claims on behalf of Engineers, Architects, Surveyors and Environmental scientists and contractors. I’ve seen insurance carrier response run the gamut from excellent to inept. Thankfully far more of the former than the latter.

One issue that is often discussed and debated between clients, carriers and their agents is: “When does a complaint cross the border into a claim?

Claims continue to rise due to Social Inflation, Aging Infrastructure, Insurance Industry change.

When can I not resolve this issue by revising our work product? When does unhappiness cross over into damages? Let’s try to answer that by starting with the definition of a claim. According to one of our frequently engaged carriers, “the insurance applies to a covered Claim, only if:

1. The Claim is first made against the Insured during the Policy Period and first reported to the Insurer, in writing, as soon as practicable during the Policy Period or during the Automatic Extended Reporting Period.

2. The Wrongful Act or the act giving rise to the Pollution Incident was committed on or subsequent to the Retroactive Date.

3. None of the Insured’s directors, officers, principals, partners or insurance managers knew or could have reasonably expected that the Wrongful Act or the act giving rise to the Pollution Incident might give rise to a Claim, either prior to the inception date of this Policy or the inception date of the earliest policy issued by the Insurer that has been continuously renewed.”

Start Here To Get Fast and Easy Comparative Rates

Puharic

And Associates, Inc.

Insurance and Risk Managers